This information is provided for illustrative purposes only. No representations and warranties are made as to the reasonableness of the assumptions. Certain assumptions have been made for modeling purposes and are unlikely to be realized. Changes in these assumptions may have a material impact on the backtested returns presented. General assumptions include: XYZ firm would have been able to purchase the securities recommended by the model and the markets were sufficiently liquid to permit all trading. Backtested results are calculated by the retroactive application of a model constructed on the basis of historical data and based on assumptions integral to the model which may or may not be testable and are subject to losses. The results reflect performance of a strategy not historically offered to investors and does not represent returns that any investor actually attained. Backtested performance is not an indicator of future actual results.

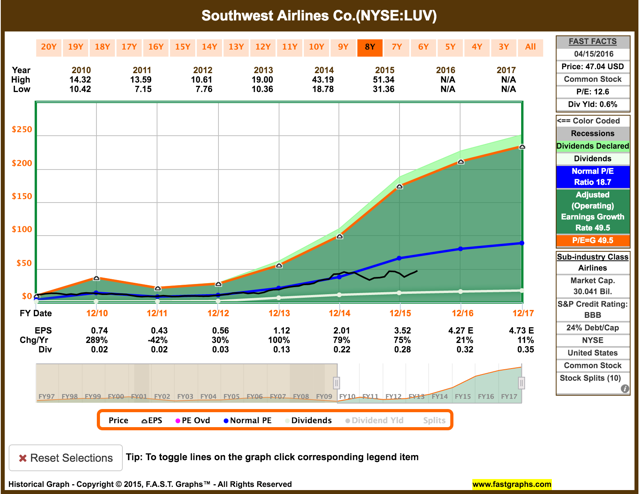

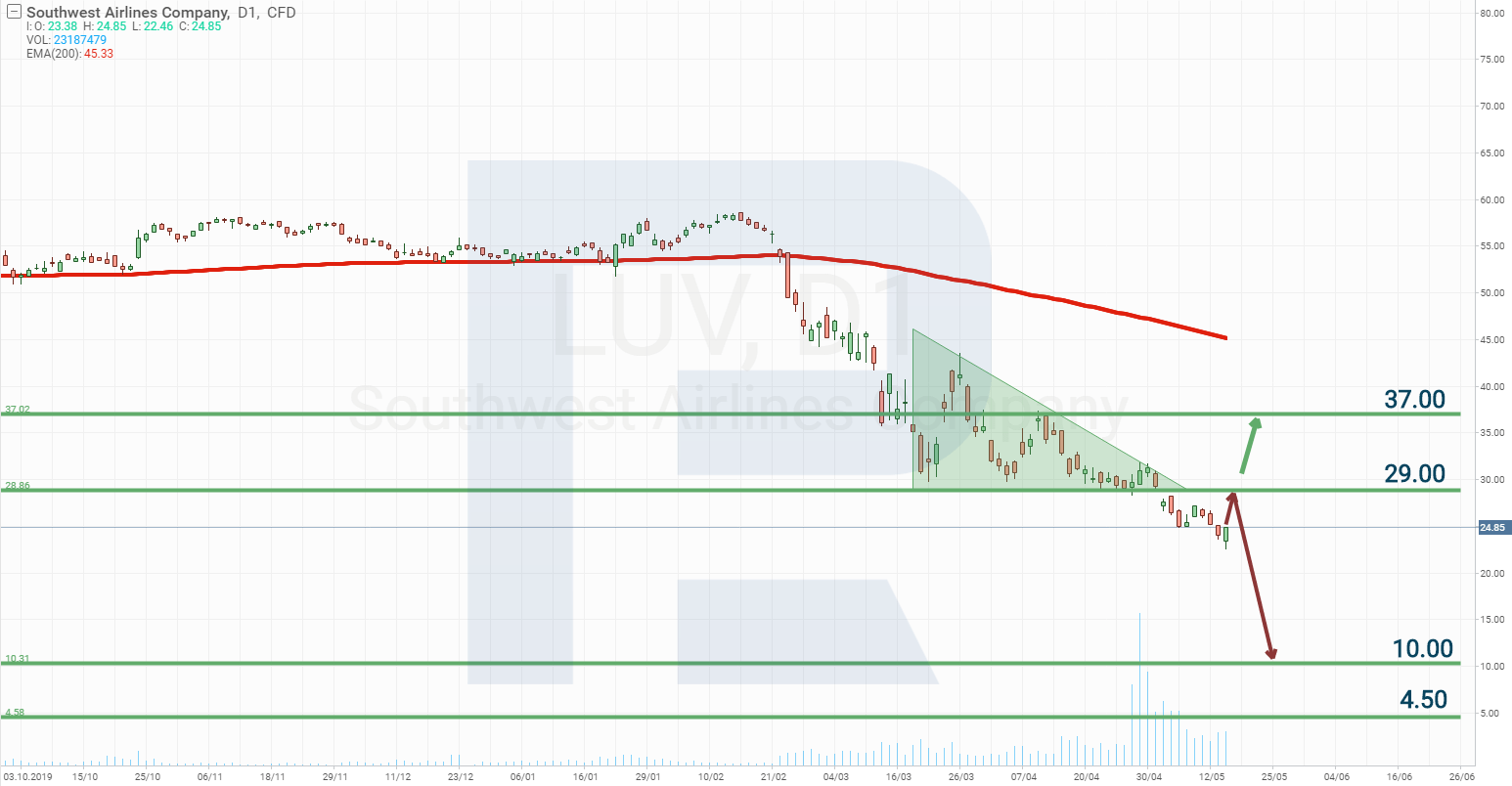

What if you’re looking for a more balanced portfolio instead? Here’s a high-quality portfolio that’s beaten the market consistently since 2016.Disclaimer: The TipRanks Smart Score performance is based on backtested results. ( related: Are Long-Term Trends In Favor Of Boeing Stock?) Given Southwest and JetBlue’s strong balance sheet, we believe both stocks have low downside risk from short-term demand shocks.Thus, profiting from short-term dips remains a key strategy for airline stocks. Interestingly, dividends and share repurchases stand suspended until September 2022 as per a clause under the CARES Act.However, slow growth and a loaded balance sheet negatively affect shareholder returns during recessionary periods. Higher financial leverage coupled with continued revenue growth is a boon for generating surplus equity returns.Moreover, Southwest’s cash & cash equivalents stand taller than its long-term debt obligations. Per recent filings, JetBlue reported $3.7 billion of cash & investments against total debt of $4.4 billion.

We compare the historical trends in revenues, margins, and valuation multiple of both companies in an interactive dashboard analysis, Southwest Airlines vs JetBlue Airways: Industry Peers Which Stock Is A Better Bet?– parts of which are highlighted below.īoth companies have sizably low long-term debt obligations primarily due to the government’s assistance during the pandemic and consistent growth in air travel demand. Therefore, considering JetBlue’s consistent revenue growth before the pandemic, comparable profitability to Southwest Airlines, and strong balance sheet, Trefis believes that the stock is a good value investment. Also, the third phase of the payroll support program restricts airline companies from returning capital to investors as dividends and share repurchases until September 2022. JetBlue incurred just $683 million of operating cash burn last year which is much lower than the $2 billion drop in market capitalization since February 2020. The shares of JetBlue Airways (NASDAQ: JBLU) currently trade 30% lower than pre-Covid levels as compared to a 13% decline in Southwest Airlines stock (NYSE: LUV). (Photo Illustration by Igor Golovniov/SOPA Images/LightRocket via Getty Images) LightRocket via Getty Images KIEV, UKRAINE - 8: In this photo illustration the JetBlue Airways logo is seen displayed on.

0 kommentar(er)

0 kommentar(er)